Guaranty Bank Business

Rating: 0.00 (Votes:

0)

Life is hectic. You’re busy with work and personal life, and you need the convenience of full-service banking on the go.

Guaranty Bank Mobile Business Banking is the solution.Our app enables you to use your mobile device to keep tabs on your finances at all hours of the day or night, and from wherever life may take you. Download Guaranty Bank Mobile today and see how quick and easy banking can be.

With Guaranty Bank Mobile Business Banking:

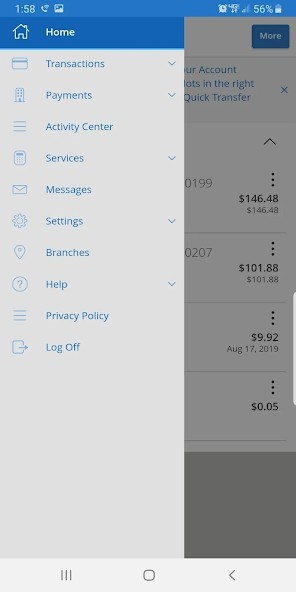

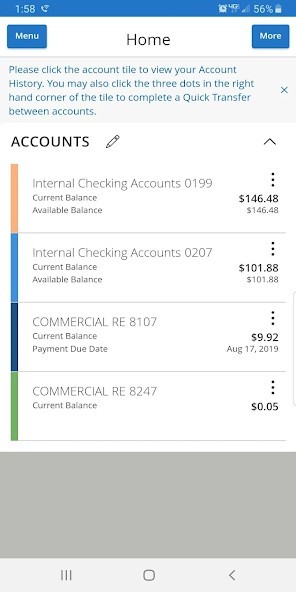

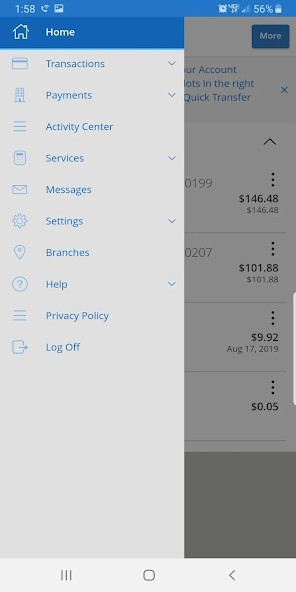

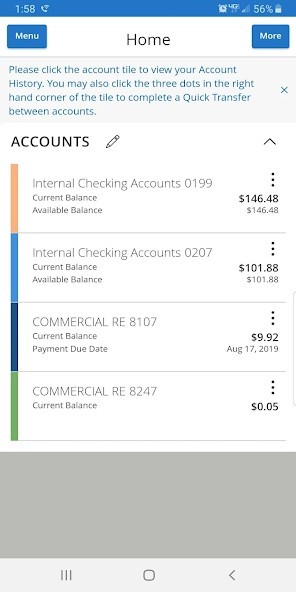

• Check account balances

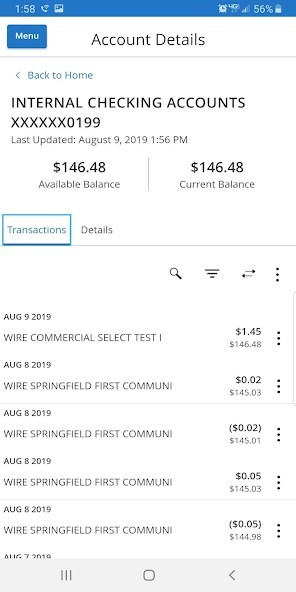

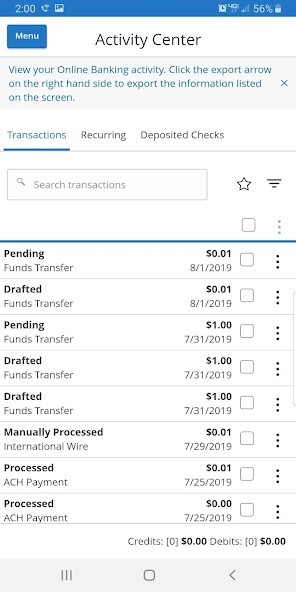

• View account activity & statements

• View check images

• Transfer funds / make loan payments

• Deposit checks with Guaranty Bank Mobile Deposit*

• Pay bills or send money to individuals for FREE**

• Receive account alerts**

• Fast, secure login using your fingerprint***

You can rest easy knowing that your information is safe and secure with Guaranty Bank Mobile. We use the latest technology combined with multi-layered security to give you peace of mind. Simply login using the same credentials you use to access Guaranty Bank Online Banking.

To access Guaranty Bank Mobile Banking, you must be a Guaranty Bank customer and have Online Banking enabled. To sign up for Online Banking, please visit Gbankmo.com or stop by and speak with one of our friendly bankers.

For more information regarding Guaranty Bank Mobile Business Banking, or for support, please call us at 417.882.8111 or visit our location at 2006 S. Glenstone Ave in Springfield, MO.

*Mobile Deposit enrollment form available at Gbankmo.com or apply in person at our above listed location.

**Data and text message rates from your mobile carrier may apply.

***Available for devices that support biometrics.

Member FDIC.

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category